how to lower property taxes in texas

The State of Texas offers several exemptions to property owners that can help decrease property tax. This proposition increases the homestead exemption.

How To Protest Your Property Taxes In Texas Home Tax Solutions

For reference weve linked a few popular local.

. Automate Lodging Taxes With MyLodgeTax. The Foundation has developed a balanced practical solution to lower property taxes by eliminating the maintenance and operations MO property taxes while also funding the needs for critical services. Lowers school taxes for those that are 65 or.

Most taxing districts evaluate property values every two years and in down markets rarely lower the property values without a protest from the homeowner. Since 1946 weve been helping people and businesses with property tax relief throughout Texas to improve their financial situation and reduce the risk of foreclosure or bankruptcy. Ad Find Top Rated Solar Companies in Your Area.

We have formed relationships with the appraisal districts we have state of the art computer programs and do the research needed to get you the lowest possible value. The most dependable way to get property taxes lowered in Texas is to qualify for a property tax exemption. Multiply that number by your districts tax rate and you have your property taxes.

1 day agoThe laws essentially limit tax growth to 25 for school districts and 35 for local governments according to the report. The second measure would raise Texas homestead exemption from 25000 to 40000 for school district property taxes which would save the average homeowner about 176 on their annual property. Add all of the taxing units dollar amounts to determine your total tax bill.

Appeal your property taxes EVERY YEAR. There are two ways for homeowners to decrease their tax billsIt can also take up to ten years for an appraisal districts appraisal districts appraiser to agree to fix an appraisal valueAside from these two purposes Texas residents are eligible for property tax exemptions on the other hand. Proposition 1 will lower property taxes for certain disabled and elderly citizens while Proposition 2 will increase homestead tax exemptions.

SB 2 would cap property tax levy increases at 25 percent while SJR 76 aims to mitigate property taxes by shifting part of the burden to sales taxes instead. OConnor Associates is the largest Property tax Consultant firm in Texas. Check out the 2 recent propositions passed in the state of Texas to help lower property taxes Proposition 1.

A lower tax obligation. If these jurisdictions exceed this cap the public can petition for a rollback election. If those two figures dont line up you should be able to reduce the assessmentand pay less.

One of the ways to lower your property taxes in Texas is to qualify for any one of the different exemptions available. File a property tax protest State laws allow you to file a protest against high property taxif you believe them to be unfair. First and foremost homeowners must claim their homestead exemption.

Ad Lodging Tax Doesnt Have to Be Complicated. If We Cant Lower Your Property Taxes You Owe Us Nothing. In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value.

Crouch recently testified before lawmakers in Austin in support of House Bill 2311. Log in to your DoNotPay account in a web browser Locate the Reduce Property Tax feature Answer the chatbots questions about you and your property We will create a customized guide for you to use when handling property tax issues. You should however note that the requirements in your county will determine whether you are eligible for a specific exemption.

Every state has slightly different rules and regulations for property tax protests. Do not pay anyone for this. If you get a reduction but not under the cap you owe us nothing.

Get Pricing Calculate Savings. The Texas legislature is considering two pieces of legislation Senate Bill 2 and Senate Joint Resolution 76 which are aimed at reducing local property tax burdens. Here are 4 simple actions to take to help your appeal be as successful as possible.

Calculate Your Cost To Go Solar. Ad OConnor Associates is the largest Property tax Consultant in Texas. This is important because the process can be arbitrary.

Check if you are eligible for tax exemptions under homestead laws and notify your county assessors office to reduce property tax. We can help you pay your property tax bill or pay delinquent property taxes through a structured affordable property tax loan. So if your property is assessed at 300000 and.

The Homestead Exemption Residential homestead exemptions remove a portion of a homes value from taxation. Therefore check the following items. The formula they use follows.

Check Rebates Incentives. Tax bills may still. Appraisal district chief appraisers are solely responsible for determining whether or not property qualifies for an exemption.

The Tax Assessor-Collector The appraisal district sends a certified assessment roll to the tax assessor-collector who then adds the regional tax rate to the propertys valuation to create a tax charge. Filing exemption applications is easy and free. If you fight to lower your taxes every year you have a greater chance of significantly reducing your taxes.

By taxing a lesser value you of course pay less in property tax. Exemptions are based on who owns the property and how the property is used. Deficit 1500000 Total Property Value 230800000 Tax Rate 650 New for 2020 under SB-2 Texas cities and counties can now only collect 35 a change from 8 more in revenue from the previous year without voter approval.

Lets cover some of the possible tax exemptions that you may be able to leverage in order to lower your property taxes in Texas. Qualifications and application procedures vary by. Reduce Texas Property Taxes With a Property Tax Exemption.

Using your votes efficiently can ensure lower property taxes in Texas. Applications for property tax exemptions are filed with the appraisal district in which the property is located. In fact many Texans are living with the fear that exorbitant taxes could take their home away or keep them from buying their first home.

Look up the protest process with your district. There is no fee unless you save actual tax dollars. Assessed value minus exemptions taxable value.

If youre lucky your tax assessor will agree to a reduction without requiring you to file a tax. Take a look at the full list of exemptions available to Texans online at the Texas Comptroller of Public Accounts page. Here is how to use our practical service.

The general deadline for filing an exemption application is before May 1. That legislation would limit the amount an appraisal. If your home is valued at 75000 for example but you have a 10000 exemption you are only taxed on the new value 65000 75k 10k exemption.

Each county taxing unit multiplies the taxable value by the taxing units tax rate to determine their share of the property tax collected.

Texas Property Tax Protest Tips Learn To Reduce Taxes

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Tac School Property Taxes By County

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Property Tax Appeals When How Why To Submit Plus A Sample Letter

How Taxes In Texas Compare To Other States Guide To Texas Property Tax Comparison Tax Ease

/https://static.texastribune.org/media/files/4cb5621a1321941aca5f8d0b30d6a83b/share-art.png)

How Do Texas Governments Calculate Your Property Taxes Here S A Primer The Texas Tribune

/https://static.texastribune.org/media/files/e6a25cb17ab2c3572ed710eb3748ddc0/Housing%20North%20Austin%20AI%20TT%2007.jpg)

Analysis Texas Property Tax Cut Measure Passed With The Long Game In Mind The Texas Tribune

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

:watermark(cdn.texastribune.org/media/watermarks/2018.png,-0,30,0)/static.texastribune.org/media/images/2017/08/12/UP9A0022.JPG)

Property Tax Relief Available To Texas Homeowners Through Homestead Exemptions The Texas Tribune

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Tac School Property Taxes By County

Why Are Texas Property Taxes So High Home Tax Solutions

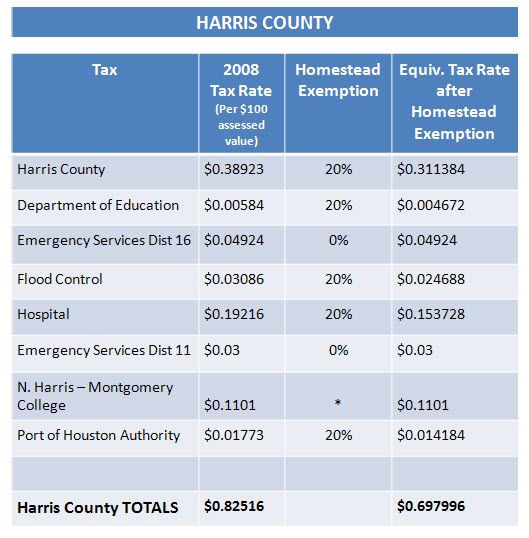

Who Has Lower Real Estate Taxes Montgomery County Or Harris County Discover Spring Texas